Serving all Florida Residents

(813) 618-7196

We help people with life insurance... that simple!

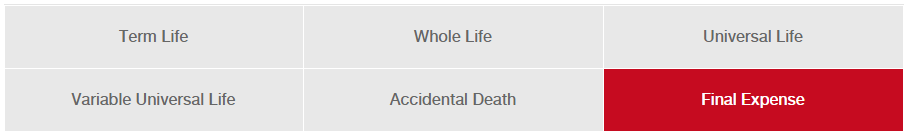

Life Insurance Plans Covering Newborns To Nursing Homes

By definition, Final Expense [Whole Life] plans are up to $50,000 in face value and primarily target the funeral costs. However, these plans can also cover end-of-life costs such as outstanding hospital bills and small debt. More importantly, these plans start as little as $15 a month.

These plans are an excellent way to cover siblings, parents, grandparents (and any relationship where there is an insurable interest). Perhaps the biggest benefit is that Final Expense can preserve any existing plans by targeting the funeral costs; therefore, allowing your bigger plans to be paid to your beneficiary(s).

*We also offer Term Life plans that exceed the $50,000 Final expense limit (up to $300,000) for those wanting to cover tuition or mortgage.

Virtual Appointment

Term plans are not the same. Does yours pay you back?Introducing Return of Premium (ROP) policies that just don't end...they pay 98%-100% of your premiums back at the end of its 20yr contract.

|

Whole Life Plans

Term Plans

|

Riders

Retirement and Legacy

|

* Final Expense Policy Insurance is a financial services subsidiary of Veritable Planning & Solutions, PLLC that contracts with: Senior Life and Mutual of Omaha insurance companies.

"...Now Father, when we've gone the last mile of our way, when it's your time to call and ours to answer, give us a home in your kingdom where we can praise thee forever more. This is your servant's prayer, Amen."